Can you believe someone once paid around $92.5 million for a slice of pizza (by today’s Bitcoin price)?

Let’s hope it was made of diamonds…or antimatter, for that matter.

Although no one ever actually handed over that amount of money for a slice, in 2010, programmer Laszlo Hanyecz really did pay 10,000 BTC (now worth $1.48 billion AUD, although this fluctuates regularly!) to 19-year-old Jeremy Sturdivant to deliver two Papa John’s pizzas. If you do the math, that’s around $92.5 million per slice by today’s (30/4/25) value, for something worth around $41 USD in 2010.

I’m sure Laszlo has stopped kicking himself by now for his serious case of munchies, but the internet will never let him live it down. He’s gone down in history as the first person to pay for real goods using experimental currency.

Bitcoin: The Early Days

Back in 2010, only one year after Bitcoin was created, people considered it more of a maths game you played on your computer than a way to get rich. People didn’t hold onto the Bitcoin. They spent it, shared it or lost it on old hard drives.

It wasn’t worth much at that stage in the cryptocurrency experiment because no one really accepted it as payment. It was more like a nerd’s version of Candy Crush, except the latter never rewarded you with real candy or virtual tokens that would one day be worth an actual mint.

Although it had no official market value in 2009, by mid-2010, Bitcoin had begun appearing on exchanges at fractions of a cent. Few people saw the potential for the Bitcoin price to skyrocket as it has today, aside from, perhaps, the elusive inventor, Satoshi Nakamoto.

Satoshi, the acclaimed yet anonymous inventor of Bitcoin, wrote a whitepaper detailing the potential for a new virtual currency at a time in humanity’s history when people were growing increasingly wary of the banking system. It was October 2008. The bubble had burst, and the big banks and investment firms were coming crashing down. People distrusted the messaging they’d always taken for granted, i.e., ‘Your money is safe in the bank.’

This is perhaps why the idea took off in such a way. Because of great timing, the algorithm of life launched Bitcoin on a trajectory that would never again be repeated. In January 2009, Bitcoin launched first and launched hard.

Real-world adoption of Bitcoin kicked off between 2011–2014, led by platforms like BitPay, Overstock and WordPress. They opened the door for the cryptocurrency to be used like real money for goods and services, instead of people just mining and hoarding it. And with that, the continuous but somewhat erratic Bitcoin price climb began.

The Rise and Fall of Mt Gox

In July 2010, Mt. Gox launched as a Bitcoin exchange (they previously traded game cards) and quickly became the place to trade BTC. Early trading prices were around $0.00076 (USD) per BTC, based loosely around the cost of electricity to mine it.

Within a year, the exchange had grown, but unwittingly fell victim to a hacker who gained access to an admin account. The hacker artificially manipulated the order book (not the blockchain), causing a crash that sent the Bitcoin price from around $17 to $0.01. Mt Gox was none the wiser as to the reason, so nothing was done about the hack. For the next two years, the exchange continued to grow, along with the undetected siphoning of nearly 800,000 Bitcoin from people’s wallets, worth approximately $500 million at the time.

The Bitcoin price continued to rise to over $1100 USD by late 2013. More and more people were opening a Bitcoin account. But by the time Mt Gox finally clued on and exposed the hack (and the final tally of around 850,000 in missing Bitcoin) to the general public in 2014, consumer faith was shaken, and the price crashed to around $400 BTC, the largest Bitcoin crash so far.

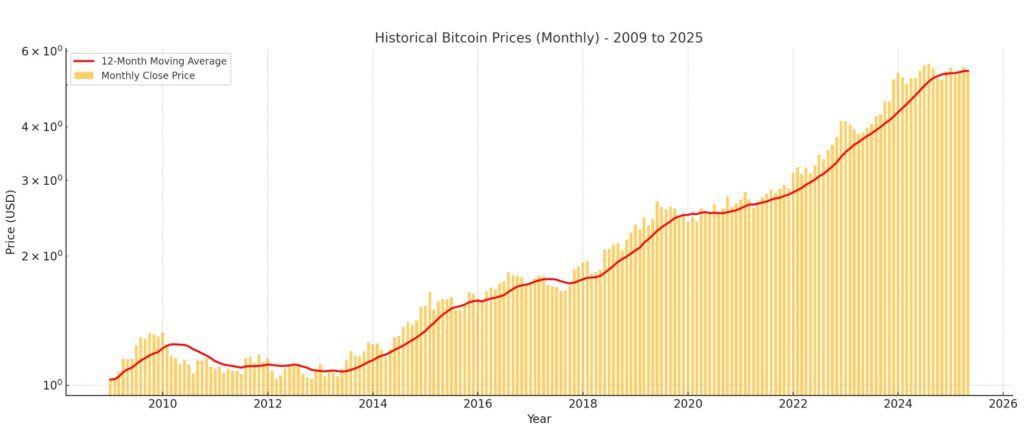

Yes, the value of Bitcoin has fluctuated dramatically since its inception.

Here’s a visual summary of Bitcoin’s price history before we dive further into the details.

Bitcoin Price History Chart

2014-2016: The Long Hybernation

From 2014 to early 2017, not much happened with the price of Bitcoin. The market had lost confidence following the Mt Gox debacle.

The media dismissed Bitcoin as a silly fad. People lost interest in what they saw as a failed experiment, and many early adopters jumped ship. The PR story of Bitcoin went quiet, and so did the market.

However, in the background, new exchanges and wallet technology were becoming more reliable and available as people needed places to safely store Bitcoins. The developers who still believed in the concept kept working to improve the infrastructure. The scene was being set for the bull run to follow.

Wealthy Chinese investors hedged their bets against the falling Yuan, and invested heavily in Bitcoin with their own Chinese crypto exchanges like BTC China (BTCC), OKCoin and Huobi. The Chinese government tolerated this for the time being.

In mid-2016, Bitcoin’s second halving occurred, returning miners 12.5 Bitcoins per block mined. Whispers of government and corporate interest slowly helped the Bitcoin price rise from $400 per BTC to around $1000 in January 2017.

2017: From Boom to Bust

By 2017, Bitcoin experienced a revival so big and unlikely that it could only be rivalled by an Easter Sunday rise of Martha Stewart.

The narrative changed, and everyone was talking again about Bitcoin: the bros, your friends and family, the media. Everyone wanted a piece, and the feeding frenzy began.

FOMO became a driving force behind the rapid growth, as no one wanted to miss out on another dot-com style boom. People threw money at anything blockchain.

The more people witnessed the rising price of Bitcoin, the more they wanted in, and at the time, there were few barriers to entry. New Bitcoin trading apps made it easier and safer to invest.

But it was like the Wild West in crypto land: a lack of enforcement of regulations, barely administered anti-money laundering laws, and no requirement for exchanges to know who was investing. That meant more anonymity, fewer limits and a growing sense that this was untouchable money.

All of this spooked the Chinese government, which felt like it was losing control. So, by September 2017, China cracked down and banned ICOs and its own crypto exchanges in one sweeping move. This meant that the Chinese people could no longer legally invest in new coin offerings, as they needed Bitcoin or Ethereum to buy in.

With Bitcoin conversations everywhere and no one wanting to miss out on the next Amazon or Google boom, by the end of 2017, the Bitcoin price was up to $20,000 per BTC.

They never saw the crash coming.

2018: Down, Down, Bitcoin Prices Are Down

By the end of 2018, Bitcoin prices had crashed to $3,000 per BTC, taking consumer confidence with it once again.

It turns out, the hype wasn’t able to quite live up to expectation and the infrastructure wasn’t as solid as thought. Many other ICOs were flops or scams and the people became weary of investing in garbage and having to wonder whether they would be the next to lose out big.

With the Chinese and US governments investigating ICOs and exchanges, many people panicked and sold. Without interest from institutions like the big banks, there was no one to buy up all the dumped stock, so the price crashed.

The volatility and constant fluctuations of the Bitcoin price drove many people back to traditional investing.

2019: The Climb Begins…Again

The bear market of 2019 meant that the system was slowly reconciling and recovering behind the scenes. The bear was in hibernation, sleeping away the trauma of the last year and growing stronger.

Long-termers held tight, regulation started to clarify and everything became a whole lot more stable, causing the price to steadily climb back up to $10,000 by the end of the year, just in time for the shamozzle that was COVID-19.

In terms of the world, Covid sucked big time. But in terms of Bitcoin investment, it was the start of something bigger.

2020: The Year Straight Out of Black Mirror

If you could have placed bets, you never would have guessed at what was about to happen in 2020. Who would have started the new year thinking a single roll of toilet paper would sell for $1,000 on eBay? Not I, that’s for sure.

When the March mayhem began, there was an initial Bitcoin crash as global markets panicked, but it bounced back pretty quickly.

To get us all out of trouble, the central banks began printing money, and not for toilet paper, although there was growing concern that this flippancy would increase inflation and crash the economy as had happened in the past in Germany, Zimbabwe, Venezuela, Argentina and Turkey, so once again, people hedged their bets on Bitcoin.

Big companies like MicroStrategy, Square (now Block) and Tesla started buying up BTC, giving the market more legitimacy.

With this newfound confidence, free government stimulus money to play with (US, Europe, Australia) and a new world view, a new wave of investors entered the market.

Elon Musk and other influential investors began tweeting about Bitcoin. Gary Vaynerchuk pushed the potential for NFT investing in the blockchain, with the highly talked about digital artist Beeple selling a single, incredible artwork for $69 million through auction house, Christie’s.

And the whole world had no idea what was real anymore.

People were more open to taking a risk outside of mainstream investing. Pop culture icons and massive corporations were invested in the new world of investing, so now it was once again safe for retail investors to do the same.

By November 2021, the Bitcoin price hit $69,000 per BTC.

Bitcoin’s Price Vs. Other Cryptos: Would a Bitcoin, By Any Other Name, Smell As Sweet?

Bitcoin was the first cryptocurrency to succeed. It had the first-movers’ advantage and managed to maintain it despite volatile highs and lows. Plus, it had the sweet, sweet story behind its creation, with a Banksy-style mystery, ‘Who is Satoshi Nakamoto?’

The Bitcoin dominance occurred because the brand and story are strong. But are there any other legitimate competitors, or are all other cryptocurrencies garbage investments?

More than 2.5 million cryptocurrencies have been created, with over 5,000 new ones launched each day because it’s so easy to do so. However, some of them, like the Mayfly, only live a day before their inevitable death. These cryptos have a 50% failure rate, and most end up dead as a doornail pretty early on in the piece.

This leaves approximately 10,000 active cryptocurrencies in play in 2025, but most are useless, overhyped or outright scams.

So, how do you know if there’s a horse worth betting on?

With no barrier to entry, new businesses start and fold every day. What keeps a business going is its point of difference and marketing messaging.

As with businesses, a cryptocurrency needs to have a point of difference and some way to get the message out there. What differentiates it from all the other garbage out there?

Here are the current top 10 cryptocurrencies by market cap and their points of difference:

1. Bitcoin (BTC): The OG

The first and most trusted. It’s like digital gold. Big price, big name, limited supply. Still king of the hill.

2. Ethereum (ETH): The Builder

Powering smart contracts, DeFi and NFTs. It’s basically the brain of Web3. Slower than some, but battle-tested. It’s recently shifted from proof-of-work to proof-of-stake, which cut energy use by over 99%.

3. XRP (Ripple): The Banker’s Coin

Designed for fast, cheap international payments. Banks love it. Just got regulatory clarity, too.

4. Tether (USDT): The Dollar Anchor

A stablecoin pegged to the USD. It’s not exciting, but it’s massively used for trading and stability.

5. Solana (SOL): The Speedster

Super fast and cheap to use. Big in NFTs and DeFi, when it’s not having outages. It can handle 65,000+ transactions per second, compared to Bitcoin’s 7.

6. Binance Coin (BNB): The Exchange Token

Used across the Binance ecosystem. It offers perks like fee discounts, plus it’s got utility and volume.

7. USD Coin (USDC): The Clean Stablecoin

It’s also pegged to the USD but is marketed as more transparent and regulation-friendly than Tether.

8. Dogecoin (DOGE): The Meme with Momentum

It started as a joke and stayed for the fanbase. If Elon tweets, it moves. It’s surprisingly sticky.

9. Cardano (ADA): The Research Project

Slow and steady, focused on peer-reviewed upgrades. Much more energy efficient than Bitcoin. It has big dreams and is still building.

10. TRON (TRX): The Entertainer

Built for content sharing and entertainment apps. Lots of activity, especially in Asia.

The reason coins or tokens like Litecoin (LTC), Monero (XMR, Bittensore (TAO) and Aave (Aave) are not on the list, despite being currently valued higher than some on the list, is because:

Despite their strong tech or loyal users, they’re not growing as fast as newer coins with bigger ecosystems, institutional backing, DeFi/NFT utility and heavy media hype.

Future Predictions of the Bitcoin Price

Now that we know the Bitcoin price history, it’s easy to predict what the future will look like, although we must account for curveballs and random acts of craziness.

After every key drop in the market, there has been a bear phase where the market went into hibernation for several months to a year and then came back stronger, only to reach new bullish heights with BTC prices surging to unheard of heights. Everyone wants in on it again, from your Uber driver to your basketball mates, it’s all over the news and media, and then once the bubble is fully formed, there’s a market correction, and it pops, dropping the price.

This could be because of a number of reasons, ranging from regulation changes, a mouthy politician, an AI army uprising, or an investment influencer speaking out on social media, causing speculation. When people or corporations panic, they withdraw their investment to minimise their damage, although for other investors, this is the right opportunity to jump in and buy at a smaller price.

Unfortunately, we never really know when the top has been reached, and the downward slide is to begin, and then when/if the downward slide has hit the bottom, before it becomes the right time to buy.

Like a game of jump rope, you have to hold for the right time. Assess the horizon based on past insights and future predictions and only play with what you can afford to lose. That’s my poker strategy, too. Minimise the gamble by calculating the risk.

It’s impossible to predict what will happen in the future with absolute certainty, but with a bit of research into the past, you can more easily understand and predict the future.

Bitcoin Price Prediction: Expert Opinions

Below are expert opinions from around the world with their Bitcoin price prediction:

Geoff Kendrick (UK), Head of Digital Assets Research, Standard Chartered:

Predicts Bitcoin could reach $120,000 by Q2 2025 and $200,000 by year-end, citing rising institutional demand and macroeconomic instability. Cited in: Business Insider, April 2025

Tom Lee (USA), Managing Partner, Fundstrat Global Advisors: Forecasts Bitcoin hitting $250,000 by the end of 2025, driven by increasing liquidity and global adoption of digital assets. Cited in: Fingerlakes1, May 2025

Charles Edwards (Australia), Founder, Capriole Investments: Believes Bitcoin could surge to $280,000 in early 2026, referencing historical price movements after previous halving cycles. Cited in: BeInCrypto, April 2025

Matthew Sigel (USA), Head of Digital Assets Research, VanEck: Projects Bitcoin will reach $180,000 by the end of 2025, calling it a modern alternative to gold during speculative market cycles. Cited in: CoinEdition, April 2025

Anthony Scaramucci (USA), Founder, SkyBridge Capital: Predicts Bitcoin will hit $200,000 in 2025, citing increased investment infrastructure and mainstream adoption. Cited in: MarketWatch, March 2025

Michaël van de Poppe (Netherlands), Crypto analyst and CEO of MN Trading Consultancy: Anticipates Bitcoin reaching between $200,000 and $300,000 in 2025, based on historical cycles and current adoption trends. Cited in: CryptoTips.eu, March 2025

Dhaval Joshi (UK), Chief Strategist, BCA Research: Suggests Bitcoin could exceed $200,000, describing it as a superior inflation hedge and safe-haven asset compared to gold. Cited in: MarketWatch, April 2025

Alex Thorn (UK), Head of Research, Galaxy Digital: Forecasts Bitcoin could reach $150,000 to $185,000 by the end of 2025, driven by adoption from institutions and even nation-states. Cited in: Financial News London, March 2025

FAQs

What caused Bitcoin’s price to hit $20,000 in 2017?

A mix of mainstream curiosity, media hype and the ICO (Initial Coin Offering) boom. To buy into most ICOs, you needed Bitcoin or Ethereum, so everyone rushed to buy in, pushing prices sky-high. It was like musical chairs with digital gold.

How does Bitcoin’s halving affect its price?

Halving cuts the reward miners get for validating transactions, reducing new Bitcoins availability by half. When there’s less supply with the same or more demand usually pushes the price up. It’s the scarcity principle at work.

Why is Bitcoin’s price so volatile?

Because it’s still a young market, and emotions run the show. Regulation, hacks, global news and Elon Musk tweets all cause price swings. There’s no central stabilising force, so it moves more like a rollercoaster than a steady investment.

What factors influence Bitcoin’s price today?

Supply and demand, macroeconomic conditions, institutional adoption, regulation, global conflict and even AI-driven trading bots. It’s a mix of people, politics and code.

Can Bitcoin reach $100,000 or more in the future?

At the time of writing this, the price hovers around $96,000 USD, although it also dipped to around $94,000 within days. It’s likely the price will rise above $100k, but it’s a volatile investment, and it could go either way. Plenty of analysts think it will continue to rise, at least about $100k, especially after halvings or when large investors jump in. That said, nothing is guaranteed. It could hit $100K or drop to $30K first. Timing is everything.

How do Bitcoin and other cryptocurrencies correlate in terms of price history?

Bitcoin usually sets the tone. When it moves, most other coins follow. Ethereum sometimes moves on its own news, but generally, the market rises and falls with Bitcoin.

Why did Bitcoin’s price drop in early 2018 and again in 2022?

In 2018, the ICO bubble burst and reality kicked in. In 2022, the collapse of big players like Terra and FTX caused panic. Both times, the hype train ran out of steam, and the market corrected hard.

A note about investing in Bitcoin

**Although the Bitcoin price prediction in this article may seem a compelling reason to invest, this is a very volatile market, so you should only consider investing what you can afford to lose.

This article cannot advise you on your own financial risk profile. I would recommend seeing a financial planner or speaking with an expert who can advise you on investing within your own financial comfort zone. **