Bitcoin’s limit of 21 million coins is the primary reason it earned the moniker ‘digital gold’. Like precious metals, there’s scarce quantities of Bitcoin and they’re viewed as hard to mine.

Only a small percentage of the total supply of Bitcoin is yet to be mined, but the way the network is built means its cap won’t be reached until over 100 years from now.

The question is, will Bitcoin’s supply constraint and release schedule drive demand and long-term value? Discover how the Bitcoin network’s supply mechanics work and how it impacts BTC’s price action.

Bitcoin’s finite supply and gradual release schedule

While Bitcoin has a hard cap of 21 million BTC, not all of these coins have been created yet. Bitcoins are created through Bitcoin mining: a process that takes place continuously and results in the gradual creation of Bitcoins over a long period of time.

As of August 2025, approximately 19.9 million BTC have been created and entered into circulation. That’s about 95% of the total maximum supply.

When Bitcoin first launched way back in 2009, the circulating supply was briefly only 50—that was the reward Satoshi Nakamoto (Bitcoin founder) got for mining Bitcoin’s first block, known as the Genesis block. Since then, the circulating supply has grown continuously as more blocks have been mined.

Bitcoin’s maximum supply is hard-coded into the software that powers the blockchain. It’s considered a crucial part of what gives Bitcoin value, and is often referred to as absolute scarcity.

There is an extremely small possibility Bitcoin’s maximum supply could be changed, but technical and governance barriers make such a seismic change extremely unlikely.

The supply will continue growing until it hits the hard cap of 21 million BTC sometime around 2140.

Bitcoin supply: key figures

| Total supply cap | 21 million |

| Circulating supply 2025 | 19.9 million |

| Remaining BTC to be mined | 1.1 million |

| Next halving event | 2028 |

| Estimated year final BTC will be mined | 2140 |

Why does Bitcoin’s supply slow down?

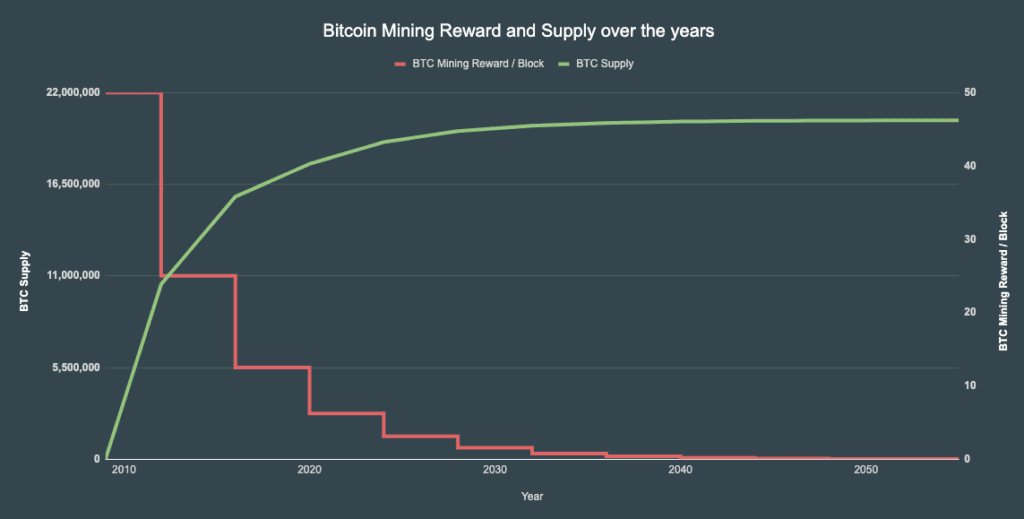

For the first four years of its existence, the supply of Bitcoin grew relatively rapidly, with every block mined resulting in the creation of 50 new BTC as rewards. Over time though, the rate of Bitcoin creation has dropped significantly. The reason? Bitcoin halving events.

Each Bitcoin halving sees the mining rewards halved, effectively slowing the rate of Bitcoin creation.

Above: Block rewards consistently decrease causing BTC supply to slow. Image source: CoinGecko

A Bitcoin halving takes place every 210,000 blocks, which works out to around once every four years (each Bitcoin block takes about 10 minutes. Four years is approximately 2.1 million minutes).

There have been five halvings to date, with a further 29 halvings to go before all Bitcoin are mined. In the final four years before the last halving, the block rewards will be just 1 satoshi (a satoshi is the smallest unit a Bitcoin can be divided into, equivalent to 0.00000001 BTC).

It’s important to note that Bitcoin’s divisibility — with each token able to be divided into 100 million satoshis — is a point that some critics raise to argue that Bitcoin’s scarcity is blown out of proportion.

How exactly is new Bitcoin created? Bitcoin mining demystified

Bitcoin mining is a somewhat abstract concept for most people, perhaps conjuring confusing images of computer nerds in a mine shaft unearthing, what? Computer code?

In broad strokes, new Bitcoin blocks (records of recent transactions on the blockchain) are ‘mined’ by solving mathematical problems — this is the ‘proof-of-work’ element of Bitcoin. Often these problems are described as being highly complex, but in fact they’re fairly simple, they can even be solved (slowly) by humans by hand.

The thing is though, to successfully mine a Bitcoin block a computer will need to solve many of these puzzles. So, it helps to have a computer specifically designed to solve these particular puzzles as quickly as possible. The puzzles themselves are simply calculating a cryptographic hash (a string of characters of a fixed length) that represents all the transaction data contained in the block to be mined.

- The hash number must be lower than a specific target number determined by the Bitcoin protocol to qualify as having successfully solved the problem.

- This target number is what determines Bitcoin’s mining difficulty: the lower the number the higher the difficulty. More computing power is needed, which increases costs for miners.

- Mining difficulty is adjusted regularly in order to ensure block times always stay around 10 minutes. That timeframe is part of the chain’s design for stability and security reasons.

A cryptographic hash based on the same transaction data will always result in the same answer, so in order to be able to keep trying to create a hash that results in a different (lower) answer, a small section of each Bitcoin block is set aside for a random number to be added. This block section is known as the nonce (number once).

Essentially ‘mining’ a new Bitcoin block means a particular computer has won a sort of game of chance where the number it inserted into the nonce resulted in a hash that is lower than the protocol’s target number.

What happens after all 21 million are mined?

When it’s no longer possible to keep delivering BTC as rewards for mining blocks, miners will instead get a cut of the processing fees that users pay for transacting on the network.

A big question remains over whether that will be appealing enough to ensure miners stick around and keep the network functional, which poses a threat to its security. Bitcoin maximalists argue the network will have a thriving user base with more use cases (e.g., DeFi apps) by then, making the fee-based model viable. But if not, and they raise fees too high, it may limit the usability of Bitcoin (and trust in the network).

Perhaps if Bitcoin is a major asset held by corporations and governments by then, they’ll pitch in to run Bitcoin mining farms (at a loss) in order to protect the network that underpins their investments.

Is Bitcoin’s supply deflationary?

Bitcoin is sometimes referred to as a deflationary asset — an asset where the supply is designed to decrease over time, which theoretically leads to its value (and your purchasing power) increasing. Right now, that description isn’t technically accurate, as Bitcoin’s supply is still increasing. A more accurate description might be a disinflationary asset, as its rate of inflation is decreasing.

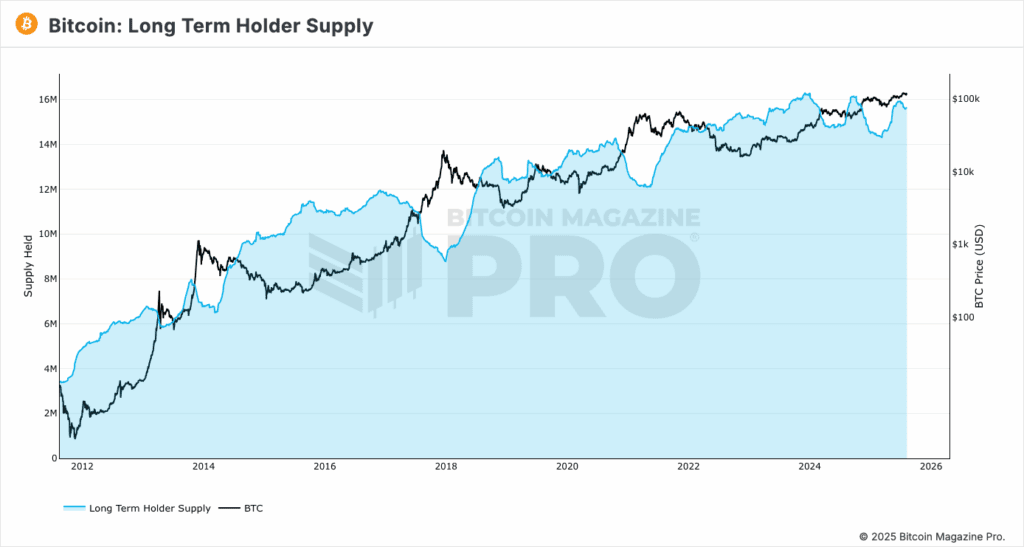

Eventually though, Bitcoin’s supply will become deflationary as more Bitcoin is lost or rendered inaccessible and the newly created supply dries up. Many BTC investors are dedicated long-term hodlers. Bitcoin’s maturity and reduced price volatility (compared to other crypto) has also seen:

- High levels of institutional investment as a store of value.

- BTC accumulation by countries, including plans for a strategic reserve in the US.

- Growing uptake of BTC by companies as a treasury asset.

This mechanism is likely to put upward pressure on price as supply becomes even more restricted.

Above: Because Bitcoin has gained a reputation as a ‘store of value’ asset, many ordinary and institutional investors hold it long-term, which limits circulating supply. Image source: Bitcoin Magazine Pro.

Scarcity is key to BTC’s value proposition

Bitcoin’s scarcity and capped supply have led to comparisons with gold. While Bitcoin hasn’t earned the same kind of trust given to traditional assets like gold and fiat currencies, growing adoption by corporations and governments shows it has a role to play as a ‘store of value’.

In particular, BTC is viewed as a good way to diversify a portfolio and hedge against inflation.

Bitcoin’s finite supply means it tends to behave very differently to fiat currencies, whose supplies are effectively infinite. Governments can increase fiat currency levels, through so-called ‘quantitative easing’, to boost the liquidity in an economy and stimulate spending. That can degrade the value of the currency: you get less bang for your buck.

Conversely, it’s not a viable option to keep increasing BTC’s supply. Over time, BTC’s finite nature should contribute to an increase in its value — provided that demand for BTC increases, of course.

Bitcoin has an obvious advantage over gold in regard to scarcity, because there will only ever be 21 million. The precise maximum supply of gold on Earth isn’t known, and the available supply tends to increase over time as new gold fields are discovered.

Yet, the fact remains that gold has real-world value (for jewellery, electronics etc.), while Bitcoin’s use cases (beyond investments) are dubious.

Gold has outpaced BTC in terms of “safe-haven flows” in a tumultuous 2025 where uncertainty has been heightened by Trump’s tariffs, according to Rob Haworth, senior investment-strategy director at U.S. Bank Asset Management Group. When financial markets look wobbly, Bitcoin’s price still tends to take a hit — whereas gold is perceived as reliable.

Will limited supply keep lifting BTC’s price higher?

Scarcity is only relevant if people need or want something: if demand is high. And what really drives demand for BTC? It’s largely driven by a desire to get rich. If another blockchain emerges as the definitive powerhouse for consumer-facing uses for blockchain, or simply becomes more popular than BTC, investors may redirect their money to where they think the returns are at.

Perceived scarcity may be a selling point for investors, but they’re just as likely swayed by Bitcoin’s incredible market dominance and increasing legitimisation as an investment by large holders, which has arisen from network effects and mainstream accessibility such as via spot BTC ETFs. And those factors, combined with positive legislative changes in the crypto sphere, make a strong case for a continued rise in BTC’s price, in my lifetime at least.